Summary

Toll roads are a global infrastructure staple, but not every owner-operator has the same return prospects. Finding the market’s best international opportunities requires a deeper look at whether the assets are mispriced.

While most brokers and advisers will be familiar with Australian and US toll road operator Transurban, its global competitors may fly under the radar, despite their sometimes-exceptional upside potential.

In our belief, international alternatives – such as Ferrovial and Vinci – offer better value for investors due to a greater degree of mispricing. Ferrovial is currently our top toll road holding, for reasons we’ll explain in this article.

To begin with, it’s worth understanding why toll roads have the potential to offer both short and longer-term value, provided they are carefully selected and managed.

Why we invest in toll roads

Toll roads have several characteristics that Lazard’s global listed infrastructure team finds appealing, including limited competition, traffic predictability and inflation-linked cashflows.

The mature toll roads we invest in benefit from inflation-linked toll price escalations under their concession contracts. For shareholders, this results in relatively predictable, incremental increases in the company’s revenue when inflation is rising. Meanwhile, much of the capital investment in the toll roads is outlaid at the beginning of the concession, which adds another layer of cashflow predictability.

As with other infrastructure assets, toll road traffic levels are fairly inelastic with changes in price. While some drivers have the choice to avoid toll roads, many will travel on them to save petrol and time. During COVID-19, there was a drop in traffic levels, but they have largely recovered since. Globally, toll roads are now back to experiencing strong demand and we anticipate predictable increases in traffic as populations continue to grow.

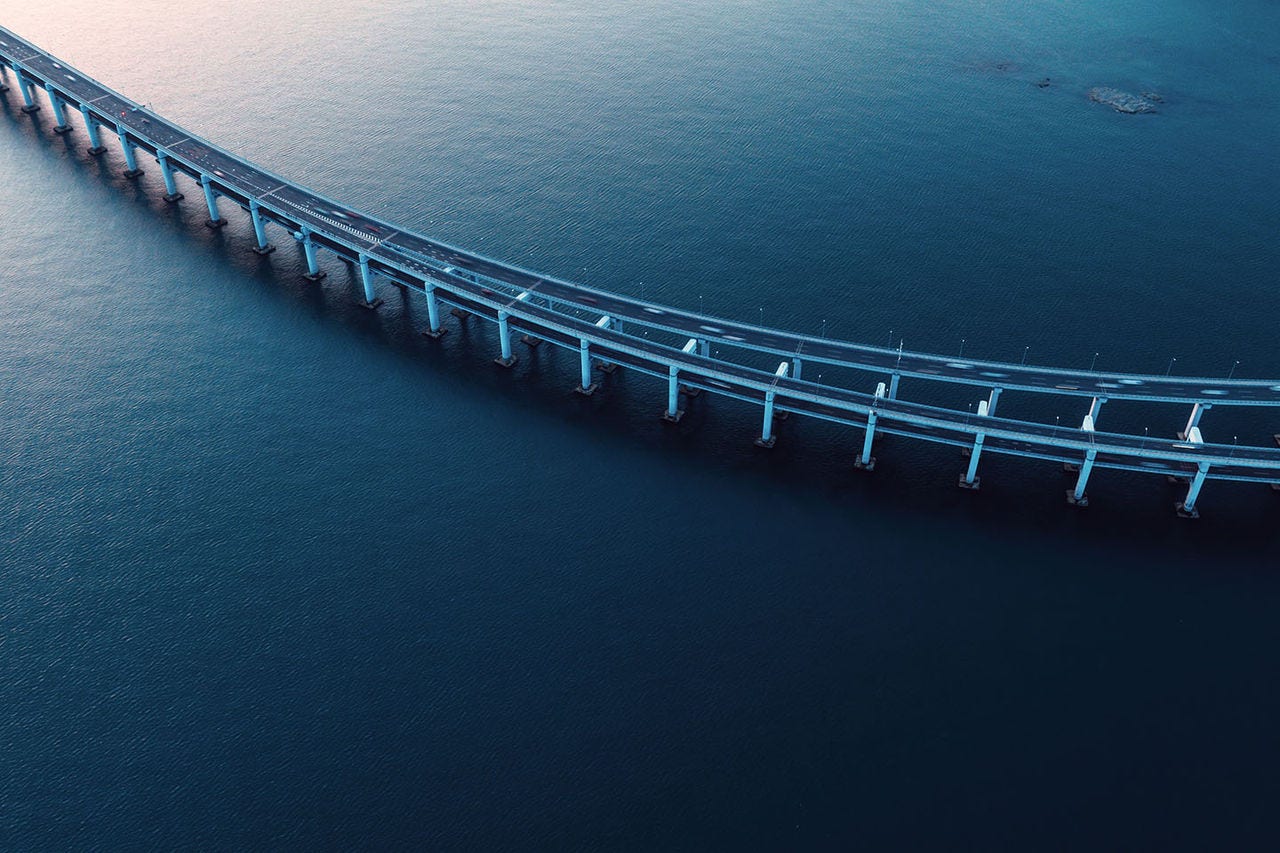

Ferrovial’s Largest Toll Road

Source: Ferrovial

Where we’ve found value

Ferrovial

Ferrovial is a Spanish company that owns a globally diverse portfolio of toll road and airport concessions. In our view, it owns some of the highest quality concession assets in the world, with most of its toll roads based in North America. Ferrovial’s key specialty is applying its operational expertise to improve the profitability of its assets. Its historically strong cashflows have also enhanced its ability to acquire new assets.

Vinci

Vinci is another globally diversified infrastructure concessions owner that primarily owns toll roads and airports in developed countries. Like Ferrovial, Vinci’s portfolio and operational expertise makes it an attractive asset.

Atlas Arteria

Atlas Arteria owns four toll roads in France and the US, and a tunnel in Germany. Its largest asset is its stake in APRR (Autoroutes Paris-Rhin-Rhone), which is one of Europe’s largest motorway networks. This stake makes Atlas an attractive portfolio of assets, from our perspective.

Transurban

Transurban owns and operates toll roads across Australia’s eastern states and the US, and meets several of Lazard’s criteria, including traffic predictability and inflation protection.

Why global opportunities require a specialist skill set

Local investors can access two listed toll road opportunities on the Australian Securities Exchange (ASX). The picture becomes more complex at a global level, however, given the myriad different countries and concession contracts.

The Lazard global listed infrastructure team focuses on assets in developed markets to reduce political risk, sovereign risk and regulatory risk, among others. Such risks would undermine the predictable return profile we seek, which is why we take a highly disciplined approach.

Once we’ve screened out companies with exposure to these high-level risks, we drill into the details of each individual opportunity. We examine regulatory structures, demographic profiles, and model volume and pricing in the underlying assets in our search for value. Where we can, we exploit the discrepancy between the market’s pricing and fundamental value. Our approach has helped us deliver consistent performance for more than 20 years.

Important Information

The purpose of this web page is to provide information about the Lazard Global Listed Infrastructure Strategy (“Strategy”) and Lazard Asset Management Pacific Co. ABN 13 064 523 619, AFS License 238432 (“Lazard”). This information is not intended as and should not be interpreted as the giving of financial product advice and must not be distributed to retail clients. All of the graphs, charts and tables have been prepared by Lazard unless otherwise stated. The information contained in this document has been obtained or derived from sources believed by Lazard to be reliable but Lazard makes no representation or warranty as to their accuracy and accepts no liability for loss arising from the use of the material in this presentation unless such liability arises under specific statute. All opinions and estimates are as at the date of this document and are subject to change.

This web page contains general financial product information only and does not take account of your individual objectives, financial situation or needs. You should get professional advice as to whether investment in the Strategy is appropriate having regard to your particular investment needs, objectives and financial circumstances before investing. Neither Lazard nor any member of the Lazard Group, including Lazard Asset Management LLC and its affiliates guarantees in any way the performance of the Strategy, repayment of capital from the Fund, any particular return from or any increase in the value of the Strategy. Certain information referenced herein contains “forward-looking statements”, identified by the use of words such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” or “believe,” or the negatives thereof or comparable terminology. Due to uncertainties regarding the future, actual events may differ materially from those contemplated in such forward-looking statements. Past performance may not be indicative of future results.

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT FOR PUBLIC DISTRIBUTION.

This page was prepared by Lazard Asset Management Pacific Co. (‘LAMP’). We may use your personal data (such as your name and email address) to send you communications including, but not limited to, event invitations, investment strategy updates, and economic and market outlook briefings, which may be of interest to you. Please read our Privacy Notice for information about how we handle your personal data, your rights to seek access to and correct information, and how to complain about breaches of your privacy by LAMP. If you do not wish to continue receiving this material from us and to unsubscribe from future emails or customize our communications with you, click on the underlined text to manage your email preferences.

This page is intended only for persons residing in jurisdictions where its distribution or availability is consistent with local laws and Lazard’s local regulatory authorizations. Please visit www.lazardassetmanagement.com/globaldisclosure for the specific Lazard entities that have issued this document and the scope of their authorized activities.