Lazard Equity Megatrends ETF

THMZ is an actively managed ETF that seeks to capture the return opportunity from global megatrends that will shape the future economy.

The World Is Changing at an Unprecedented Pace.

The next decade will look very different to the last one. Technological, demographic, and geopolitical shifts are reshaping the investment landscape. These structural shifts represent an opportunity for long-term investors adapting for the future.

Megatrend investing targets these opportunities through an unconstrained, long-term approach.

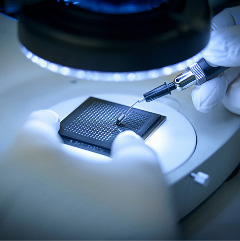

Technology

The development and integration of AI across industries is revolutionizing everything from technology to finance to retail.

Demographics Shifting demographics is influencing consumer decision-making and driving the need for innovation across the global health system.

Geopolitics Governments globally are pulling policy levers that emphasize reshoring and prioritize national security in an increasingly multi-polar world.

An Active and Dynamic Approach to Megatrend Investing

Thematic

Our proprietary themes target the return opportunity from global megatrends.

Diversified

Our portfolio is constructed with multiple diversified themes that evolve over time.

Return-Focused

Our proven process and valuation discipline aim to generate long-term returns.

Portfolio Diversification with a Multi-Thematic Approach

Our portfolio is constructed with multiple diversified themes that evolve over time. This ensures broad diversification across regions, sectors, and secular drivers. Adopting a multi-theme approach and our ability to rotate capital between themes enables us to capture shifting return opportunities and overcome the challenges in timing the selection of themes with our specialist expertise.

We believe forward-looking investors are increasingly seeking a robustly implemented, thematic approach to capture the best opportunities of the next decade—to generate long-term alpha, implementation is everything.

Steve Wreford, CFA

Portfolio Manager/Analyst, THMZ

The Future Is Megatrends

How to Invest in Lazard ETFs

Lazard ETFs trade intraday on an exchange and are available through various channels, including broker-dealers, investment advisors, and other financial services.

You can invest through your brokerage account or talk to your financial advisor.

Related Insights

Important Information

The financial data presented is provided by external sources. Lazard Asset Management LLC takes reasonable care to ensure that the information provided is correct, but it neither warrants, represents nor guarantees the content of the information nor does it accept responsibility for errors, inaccuracies, omissions or inconsistencies.

Please consider a fund's investment objectives, risks, charges, and expenses carefully before investing. For more complete information about Lazard ETFs and current performance, you may obtain a prospectus or summary prospectus by calling 800-823-6300 or going to www.lazardassetmanagement.com. Read the prospectus or summary prospectus carefully before you invest. The prospectus and summary prospectus contain investment objectives, risks, charges, expenses, and other information about the Portfolio and Lazard ETFs that may not be detailed in this document.

The Lazard ETFs are distributed by Foreside Fund Services, LLC.

Investment Products: NOT FDIC INSURED I NOT BANK GUARANTEED I MAY LOSE VALUE

Forward looking figures represent expected returns. Expected returns do not represent a promise or guarantee of future results and are subject to change.

Equity securities will fluctuate in price; the value of your investment will thus fluctuate, and this may result in a loss. Securities in certain nondomestic countries may be less liquid, more volatile, and less subject to governmental supervision than in one's home market. The values of these securities may be affected by changes in currency rates, application of a country's specific tax laws, changes in government administration, and economic and monetary policy. Emerging markets securities carry special risks, such as less developed or less efficient trading markets, a lack of company information, and differing auditing and legal standards. The securities markets of emerging markets countries can be extremely volatile; performance can also be influenced by political, social, and economic factors affecting companies in emerging markets countries.